Results

- Details

- Category: Results

Below you will find a detailed trading journal. You can also open the trading journal in a separate browser tab. Performance percentages are calculated against the margin requirement, which can change over time. Interactive Brokers has an updated list of current margin requirements.

As an example, results are shown for 1 x Micro E-Mini S&P 500 future contract (MES) and 1 x E-Mini S&P 500 future contract (ES). The price of both futures move (almost) perfectly in sync. Their respective margin requirements are roughly $1500,- and $15000,- with multiplier $5,- and $50,- per point.

New: Greed and Fear algorithmic trading - follow live for free!

- Details

- Category: News

The model portfolio that we used to run on this blog has now been replaced. The new version is called: Greed and Fear algorithmic trading. But since we're still in the phase of building a decent track record, everyone can now follow this new way of trading for free! All trades are reported in real-time in a Telegram group and channel.

If you want to be part of that, then please send me an e-mail at

Once you have joined, you can read back all messages to the very first start. At the end of the day or week, I will update the trading sheet, which you can find here with all the details: Greed and Fear Algorithmic trading - trading journal

The hot hand fallacy in trading

- Details

- Category: Blog

The hot hand fallacy in trading is a cognitive bias that occurs when traders believe that a winning streak will continue, even though the probability of success remains unchanged. In other words, traders may believe that because they have experienced a series of successful trades, they are more likely to continue to make successful trades in the future.

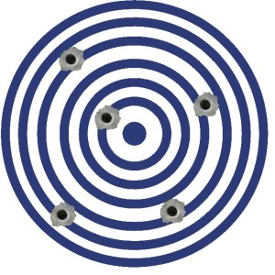

Texas sharpshooter fallacy

- Details

- Category: Blog

Every now and then when I'm reading an article from the world of behavioral economics discussing a particular phenomenon, it makes you realize once again how much trading and investing is about human behavior.